As a web based lender, Credibly is known for staying versatile with its lending prerequisite, so firms that has a minimal private credit rating score of 550 could qualify for funding.

A FICO rating/credit score is utilized to signify the creditworthiness of someone and may be one indicator from the loans you might be suitable for. Having said that, credit score alone doesn't warranty or indicate approval for virtually any economical merchandise.

Caret Down You would possibly explore crowdfunding platforms, especially if you happen to be launching a different merchandise you will be able to make Excitement around. Just be aware that managing a crowdfunding marketing campaign requires a number of legwork.

You can look at apps like Earnin for those who’re an hourly worker, and try to acquire an advance on wages you’ve now acquired this pay back cycle. As an alternative to curiosity, you’ll fork out an optional idea or regular membership. Numerous present similar-day funding, though occasionally for your payment.

Pro Suggestion In advance of implementing for your bank loan, check borrower eligibility requirements. In some cases lenders will list bare minimum income, credit rating and personal debt-to-revenue (DTI) ratio requirements on the website you can critique to ascertain regardless of whether you’re a very good applicant for the loan. Reviewing needs will let you pinpoint loans you may have the very best probability at qualifying for.

Most loans also involve you to obtain an established small business with at the least two years’ expertise. Its money-secured line of credit rating does settle for considerably less time in business.

Locate a lender that assesses your capability to repay. Reviewing your banking account facts, executing a gentle credit rating pull, examining alternative credit bureaus and necessitating proof of revenue are all signs that a lender needs you to definitely repay the loan.

Pricey repayments. Payday financial loans can need repayment within a several weeks or per month. This may be tough to pay for for those who don’t possess the income to deal with the expense. And if you roll about your repayment, you’re typically billed an additional price.

The upper Training Act and Training Office polices condition that a borrower is suitable for forgiveness just after building both 240 or 300 regular payment in an IDR plan or perhaps the typical repayment strategy.

Kim Lowe is actually a direct assigning editor on NerdWallet's loans team. She handles purchaser borrowing, such as topics like own loans, get now, fork out afterwards and dollars advance apps. She joined NerdWallet in 2016 immediately after fifteen yrs at MSN.com, where she held several written content roles together with editor-in-Main in the overall health and food sections.

Both of those Bill funding and Bill factoring assist you to borrow versus your unpaid receivables. They’re both equally obtainable different types of company loans, normally open to startups and negative-credit history borrowers.

*Issue charges are A part of your every day estimate to simplify remittances and account checking. Ideal element fees available to retailers with outstanding credit score and money power.

Overview: Founded in 2017, SBG Funding is a web based lender by having an array of organization loan selections, from term loans to website devices funding and leasing to SBA 7(a) financial loans. In addition they offer invoice financing, allowing for you to have an advance of approximately ninety p.c of your fantastic Bill quantities.

Most on the internet lenders take a motor vehicle as collateral, though banking companies and credit rating unions choose a discounts or investment account. Weigh the benefit of introducing collateral versus the potential risk of getting rid of it in the event you skip a lot of payments.

Mara Wilson Then & Now!

Mara Wilson Then & Now! Richard "Little Hercules" Sandrak Then & Now!

Richard "Little Hercules" Sandrak Then & Now! Christina Ricci Then & Now!

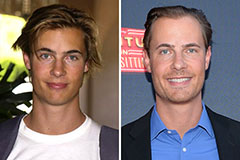

Christina Ricci Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Dolly Parton Then & Now!

Dolly Parton Then & Now!